🔑 Investors lost 95%. Here's what happened

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today:

- Why does a $2 billion company sell for $103 million?

- Don't make this business buying mistake

- How to invest $1.5 billion in hotels

🔑 What happens when VC-backed startups fail to take off?

You can probably name a dozen companies that took on venture funding and hit astronomical growth rates.

Facebook. Uber. Google. DoorDash. Airbnb. Stripe.

Early investors saw their initial capital multiple hundreds or even thousands of times.

Theses companies quickly grew to billions in revenue within a few years and dominated their market.

It's the dream outcome for a VC-backed company.

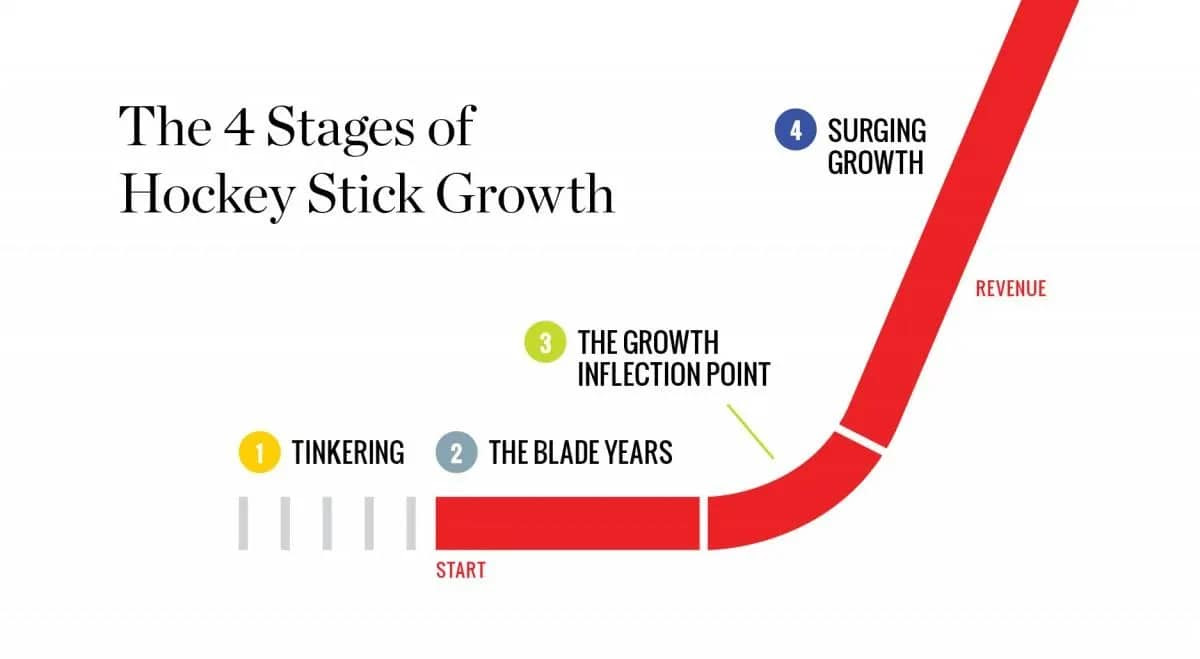

But what about the companies that fail to hit the famed 'hockey stick' growth trajectory?

Well, many simply go out of business.

The company shuts down, employees are laid off, and the remaining capital (if there is any) gets returned to investors.

But there's a third category:

Companies that don't hit the massive growth VC growth expectations, but are still valuable businesses.

Here's an example: Blue Apron, the meal kit delivery business.

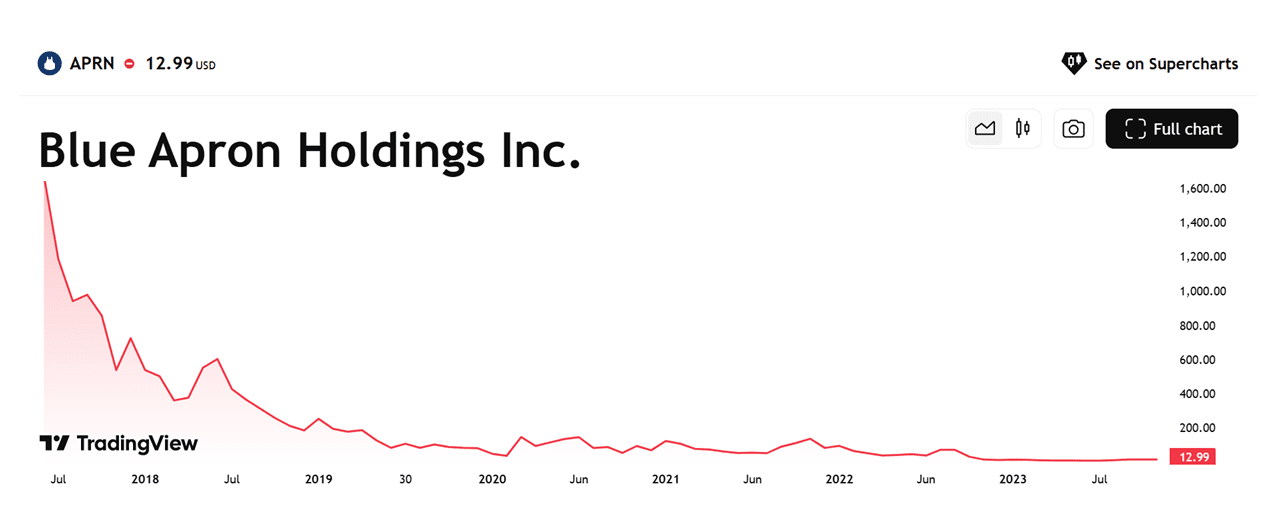

After raising $194 million in venture funding, the business reached a peak valuation of around $2 billion following its 2017 IPO.

But then things got tough.

Intense competition from rivals like HelloFresh, declining customer retention, operational inefficiencies, and net losses hit the company's stock hard.

While VCs got their payday following the IPO, the business did not hit the lofty growth expectations. It was clear Blue Apron wouldn't reach profitability with its current plan.

They needed to pivot.

So management decided to sell the company off in parts.

Blue Apron sold its operational infrastructure to FreshRealm and pivoted to an asset-light model (no more owning its own fulfillment centers and equipment).

But they continued to struggle with profitability and saw a shrinking market share in the meal kit sector.

Ultimately, they sold the business to Wonder in late 2023 for $103 million.

That's a 95% decline in value from the peak.

And remember, Blue Apron raised nearly double that amount in just venture funding. They also raised $300 million from the 2017 IPO.

About half a billion in equity went up in smoke.

But clearly, there was still some value in the business; just not the billions that early investors had hoped for.

There are thousands, if not millions, of businesses like this right now.

There are massive opportunities to reign in expenses and turn VC-backed startups into profitable, steadily-growing companies.

You won't create the next Facebook with this approach, but you could find a boring, profitable $10 million business in the wreckage of a VC-backed business.

I've written a few times on X about how we're actively looking to buy companies like this.

Lessons:

- Not every business is an infinite-growth machine. Many businesses can only grow slowly, which is perfectly fine.

- When you're investing, are you counting on 50%+ annualized growth for several years? If so, be prepared for a high likelihood of a loss of capital.

- Profitability is the new growth. If you can remain profitable and alive, your business is doing great.

🔑 Don't make this mistake when buying a business

Buying a business without getting a quality of earnings report is like buying a house without a home inspection. You’re taking a big bet without knowing what you’re buying, and it could be a disaster.

Even if the seller gives you all their financial statements, they often have very bad bookkeeping.

So, what should be in your QOE and financial due diligence package? Here's what today's sponsor Appletree says about their QOE reports:

✅ Proof of Cash

Are revenues real? We rebuild the last 1-2 years using bank statements to verify that reported earnings arrived in the bank account.

✅ Addbacks That Actually Make Sense

We normalize SDE or EBITDA with logic, not wishful thinking. The hand-waving. No “adjusting away” real costs just to make numbers look better.

✅ Working Capital Analysis

Avoid the “Post-Close Surprise” where you’re suddenly short $150k in working capital. We calculate what the business needs to operate smoothly.

✅ Forward Looking Projections

We model post close cash flow and debt service coverage under flat, growth, and decline scenarios – so you know how risky the deal really is.

If you’re sending out LOI’s or nearing a deal, don’t go in blind. Talk to Appletree for a pragmatic, thorough Quality of Earnings report – built by people who’ve bought businesses themselves.

🔑 How to invest $1 billion in hotels

I chatted with Jake Wurzak, CEO of DoveHill, a business that develops and invests in hotels.

He's invested over $1 billion into hotels and knows the industry better than anyone I know.

Jake told me about how he invests in hotels, a joint venture that almost went terribly wrong, and he even gave me some free advice on how to run my hotel in Montauk better.

Have a great day,

Sieva

P.S. - Are you hiring? Get started with top global talent from Somewhere (I'm a customer and investor)

Disclaimer: nothing here is investment advice. Please do your own research. The information above is just for information and learning.