🔑 A luxury PE investment with a 5x return

Welcome to The Business Buying Academy with Sieva Kozinsky. Here's what we have in store for you today:

- A luxury PE investment with a 5x return

- How to build an empire by driving fuel 9 hours

- Our $23 million hotel

🔑 How to turn $245 million into $1.3 billion

When you think of Gucci, you probably think of a timeless and prestigious luxury brand.

But I was surprised to learn that just a few decades ago, Gucci's future was uncertain and the Gucci family sold off the entirety of their stake to a private equity firm.

Here's the story:

Investcorp might not be a name you know, but you definitely know many of the companies they've owned: Tiffany & Co, Circle K convenience stores, and Jostens (the company that makes class rings and yearbooks).

Founded in 1982, Investcorp has built a reputation for superior performance and proven expertise across a diverse platform of asset classes. Our AUM has grown from $10 bn to over $53 bn in the past six years.

- Investcorp's website

In the 80s early 90s, Gucci was struggling with family disputes, declining brand image, and financial distress.

The company was in huge trouble.

The Gucci family sold 47% of the company to Investcorp in 1989, and four years later offloaded the rest of their stake to them.

In total, Investcorp paid about $245 million for Gucci.

Here was Gucci's problem at the time:

The luxury brand was losing its allure as it started to sell cheaper items and licensed its brand to all sorts of other companies.

Because the brand name was becoming diluted, the company was having trouble moving its higher-priced luxury goods.

Plus, infighting among the Gucci family clouded the strategic direction of the business.

In the 1990s, Gucci faced a period of significant struggle marked by internal conflicts, quality issues, and a decline in brand image. The brand's products had become associated with gaudy designs and were losing favor with consumers. A major turning point came with the arrival of Tom Ford as Creative Director in 1994, who revitalized the brand with his bold, sensual, and modern designs.

Investcorp quickly turned the business around.

They took control of the company and set a clear strategic direction: Restore Gucci's exclusive, luxurious brand feel.

They cut cheap products and ended many licensing agreements.

And they made a few key hires.

Here's a summary of the key actions that turned the business around:

- Leadership Overhaul: Investcorp appointed Domenico De Sole as CEO and supported the hiring of Tom Ford as creative director in 1994. This duo revitalized Gucci’s creative and business strategy.

- Brand Repositioning: The firm streamlined Gucci’s product lines, focusing on high-end luxury, and eliminated low-quality licensed products to restore brand exclusivity.

- Operational Improvements: Investcorp centralized management, improved supply chain efficiency, and invested in marketing to rebuild Gucci’s global appeal.

- Store Expansion: Gucci expanded its flagship stores and enhanced its retail presence in key markets like the U.S. and Asia.

Investcorp's Return

In classic private equity fashion, Investcorp looked to cash out after a few years.

The company was now massively more valuable than it was at acquisition.

Gucci did $230 million in revenue in 1993 (the year Investcorp took majority ownership). They doubled that in just two years, bringing in $500 million in revenue and a company record $83 million in profit. For reference, Gucci did about $8 billion in revenue last year.

They took Gucci public in 1995 and gradually sold shares for a total of $1.3 billion, or a 5.3x return in just a few short years.

Lessons Learned:

- Focused Strategy: Eliminating low-value products and focusing on core luxury offerings rebuilt Gucci's reputation.

- Niche Expertise: Investcorp’s experience in luxury goods allowed them to act quickly. Turning around the company in just two years wouldn't have happened without domain expertise.

- Turnaround Potential: Distressed assets with strong brand heritage can yield outsized returns with the right management and strategy.

🔑 How to Build an Empire

Want to make $15 million a month driving diesel fuel across Texas?

Bryan started a business doing it.

But it wasn't easy - he had to pay for the diesel the day after he picked it up, but customers didn't pay for 30 days.

He had to finance the orders out of his own pocket, all while hoping that his customers in a volatile industry didn't got bankrupt in the meantime.

Bryan shared some amazing stories with me during our chat. If you want to understand how to build a great holding company, listen to this.

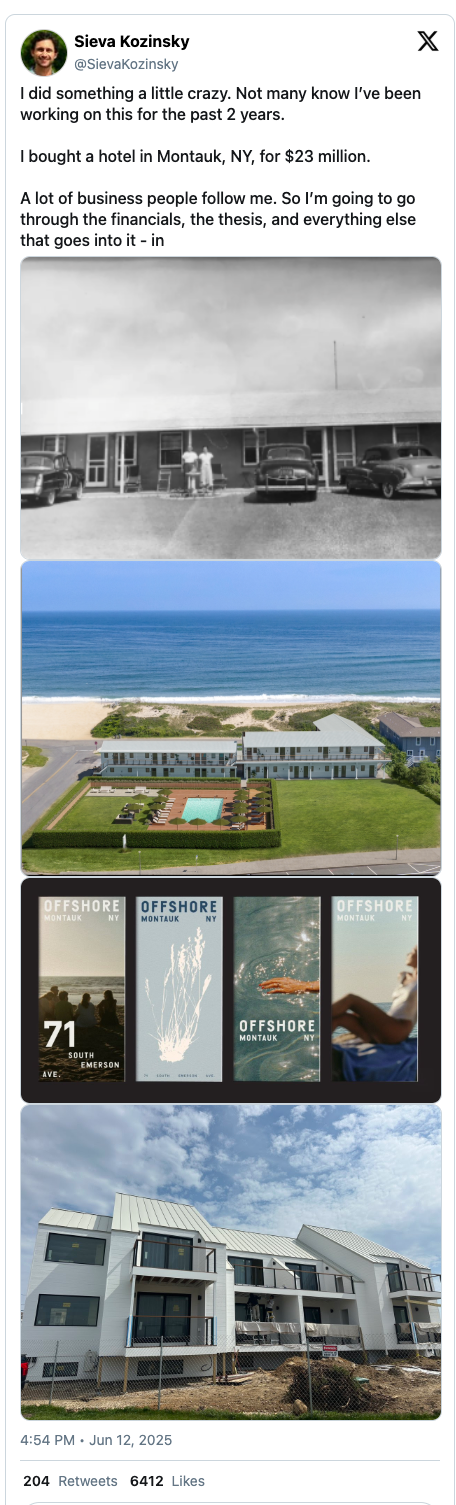

🔑 We bought a hotel for $23 million

In case you missed it, a few weeks ago I wrote about a hotel in Montauk, NY we bought and remodeled. If you haven't seen it yet, give it a read on X. We paid $23 million and put a bunch more money into fixing it up - and I shared the whole process in this post.

Have a great day,

Sieva

P.S. - Are you hiring? Get started with top global talent from Somewhere (I'm a customer and investor)

Disclaimer: nothing here is investment advice. Please do your own research. The information above is just for information and learning.

.jpg)